Flashback 1981

DID YOU find anything new in these arguments and assurances? Didn't you hear the same clamour in 1981 when we had our first big brush with the IMF and more so in 1985-86 when every day Rajiv Gandhi was taking us into the Twenty First Century?

The 1981 IMF loan came in the wake of the second oil shock. Between 1979 and 1981, the Organisation of Petroleum Exporting Countries had raised the global price of crude from $13 per barrel to around $ 35 per barrel.

However the forex position of the country was nowhere near as bad as it is today, thanks to hefty remittances from Indians toiling in the Gulf. Moreover, with the breakthrough in Bombay High, our own production of crude oil was fast picking up. Yet, overriding all opposition, Indira Gandhi went to the IMF and by November 1981, we had an IMF loan of $ 5.3 billion (Rs. 5,500 crore in terms of the then exchange rate of the rupee).

All criticism of the loan at that time was dismissed as 'so much of false alarm'. On the face of it, the situation too seemed to corroborate the official position. There was no immediate and palpable capitulation to IMF conditionalities. On the contrary, we were treated to a 'reassuring demonstration of the inherent resilience of the Indian economy' when the government boastfully turned down the third instalment of $ 1.8 billion that was due in June 1984. And it was with this exuberance of renewed confidence that the new 'Palmolive-look' Rajiv government, armed with the biggest ever parliamentary majority in Indian history, launched its first big drive towards economic liberalisation. Could anyone then dare suspect any organic linkage between the 1981 IMF loan and the 1985 campaign for 'long overdue economic reforms'?

But today as the government approaches the IMF for a still bigger loan, the emperor has no clothes on.

- India today ranks third after Brazil and Mexico in the list of borrowing nations in the Third World.

- Our total external debt has risen by $ 50 billion in 10 years, from $ 20 billion in 1980 to $ 70 billion in 1990. In rupee terms, it's a 10-fold jump in 10 years.

- In per capita terms, every Indian has a foreign loan of over Rs. 2,000. In other words, every Indian family of five has a debt-share of Rs. 10,000.

- Viewed nationally, today our external debt equals a quarter of our national income, while debt-servicing claims nearly a third of our yearly exports.

- While in 1980 our total external debt was of the order of Rs. 15,000 crore, In 1991-92 debt-servicing itself will be over Rs. 13,000 crore. Interest alone will claim a huge Rs. 7,000 crore or 1.25% of GDP.

- A loan of even $ 7 billion today from the IMF would be just sufficient to service our debt burden for only another year or so.

Deceitfully, in 1981 the IMF and Government of India had assured the country, “The level of debt and its servicing burden would remain manageable. ... Total interest payments on external debt would at no time reach as high as 1% of GDP. And the ratio of outstanding debt to GDP would be no more than 13% towards the end of the decade.” Will the IMF-WB or the Government of India take the responsibility for their false promises and our real disasters?

Far from it. Leave alone accepting that they led the country up the garden path, they are not even prepared to pause for a review. We are told that the liberalisation we have had so far has been tar too hesitant and hatting to deliver the goods. It is therefore time we gave up this path of measured and gradual reform and switched on to the hectic course of shock treatment – bold, rapid-fire, drastic changes.

Latin Amrica

US Backyard, IMF's Graveyard?

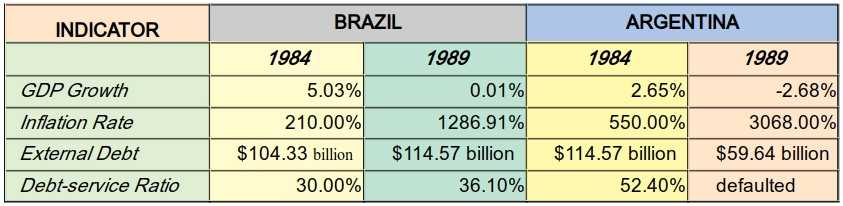

BRAZIL and Argentina. Faraway lands that conjure up images of Pele, Maradona and magic-like football. Tragic as it sounds; that is exactly what these counties have been reduced to in the playgrounds of international finance – footballs kicked around by global bankers, creditor nations, IMF and World Bank 'experts'. And their crime? Mindlessly straying into the 'offside' debt-trap carefully laid for them, and ending up as bankrupt nations unable to pay even the interest on the debt burden, leave alone the principal amounts. Reeling under astronomical rates of inflation, falling national income, runaway unemployment, these nations are frightening samples of the economic misery once prosperous nations can be reduced to due to the collusion of a corrupt ruling elite and international loan sharks. It was just two decades ago in the 70s that these countries were being touted as 'success stories' of the borrow-and-grow variety. Came the oil shock of the late 70s and these highly import dependent economies collapsed as spectacularly as they had boomed on the borrowed gunpowder.

The truth about these economies was clear for all those who cared to see it. Enticed by the cheap credit offered by foreign banks flush with petrodollars from the Middle East, the ruling elites in these nations had recklessly splurged national resources on reaching the high road of 'export-led growth' which really meant building up a vast consumerist middle-class market and inviting multinationals to grab it. But then it took just a few sharp jumps in the international price of oil, a minor recession in the advanced nations and an increase in bank interest rates to break the backs of these economies.

Threatened and pressurised by the international banking community these countries swallowed the same pill of structural reforms that the IMF has doled out to India now, namely, devaluation, opening up, privatisation, job and wage freeze. A decade later, the results show that these structural adjustments (with a human face, of course) have only further aggravated their debt burdens, rates of inflation and dependence on imports and virtually forced them into a classical colonial situation as suppliers of cheap labour and primary raw materials to the advanced nations of the West.

The lesson for India is clear : it is extremely dangerous to rush into the playfield of global fiance without a sound economic base. We must remember that the IMF and its team do not follow rules of any game – they simply play foul.