Glossary: Beyond the Jargon

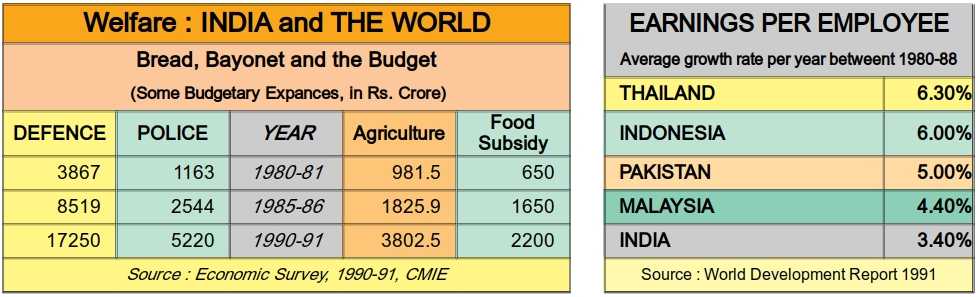

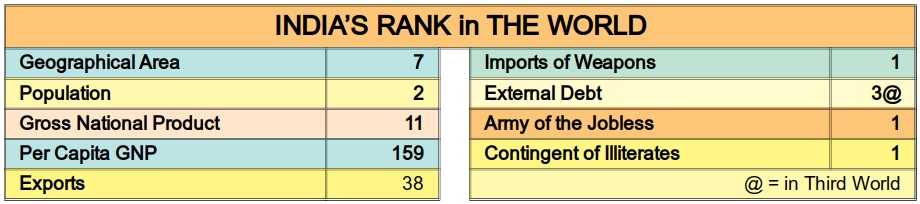

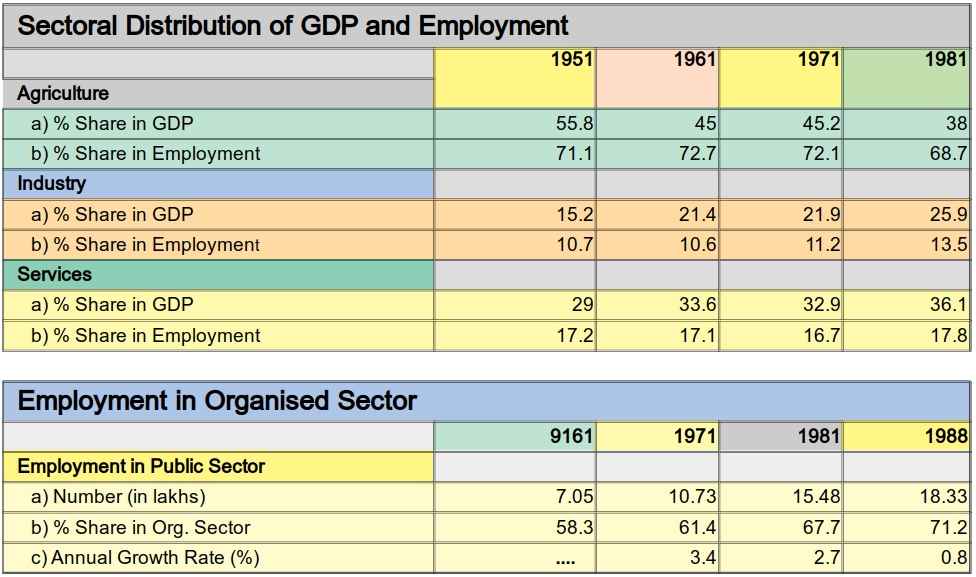

AGRICULTURE: The mainstay of the country's economy, agriculture in India is a sector riddled with paradoxes.

- Contributing a smaller and smaller share of national income every passing year it continues nevertheless to employ the major share of the nation's workforce. This implies that there is less and less of resources to be distributed among the vast and growing rural labour.

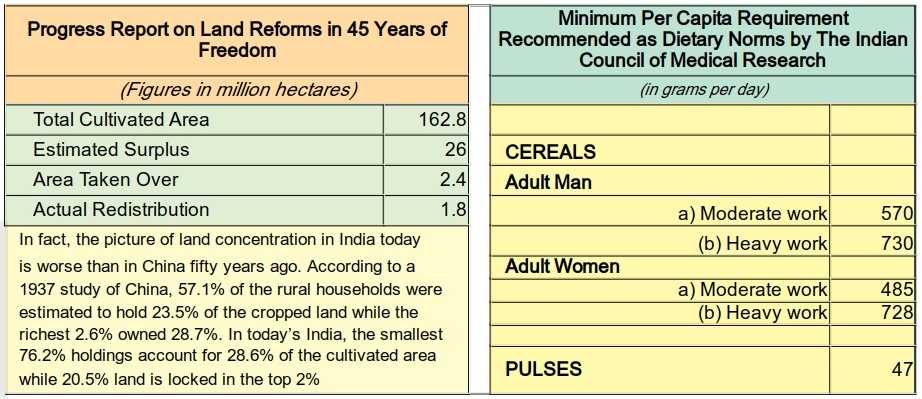

- Despite recording major growth in foodgrains production in the past decade and becoming 'self-sufficient', per capita availability of foodgrains is still far short of the minimum per capita nutritional requirements.

- Even this per capita availability is just a hypothetical concept. The real availability for toiling masses is much less as more and more foodgrains are sold through open market and the public distribution system is increasingly relegated to the background.

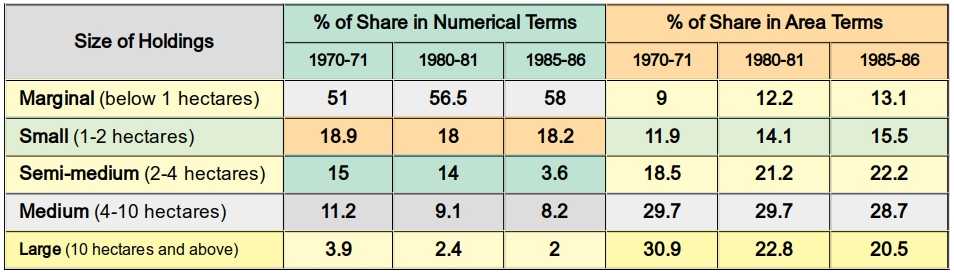

- After decades of land reforms, millions of acres still remain concentrated in a few hands denying the rural poor the right to their own land. On the other hand, in many parts of the country small and marginal farmers driven to pauperisation are joining the ranks of agricultural labour selling off or renting out their lands to big farmers.

- While the big landowners and farmers in rural India have seen unprecedented prosperity due to the green revolution the contribution of agricultural sector to national tax revenue has declined drastically.

- In a nation with not enough foodgrains to feed its people the pattern of crops being cultivated is shifting away from cereals and pulses to cash crops needed for exports and processed food items like jam, jelly, tomato sauce and potato chips.

Indian Agriculture; Some food for thought

CMIE publication, Statistical Outline of India (Tata Services Ltd.)

Land Scandal : Distribution of Operational Holdings

Source : Statistical Outline of India (Tata Services), 1989-90

BLACK ECONOMY

The Dark Invader

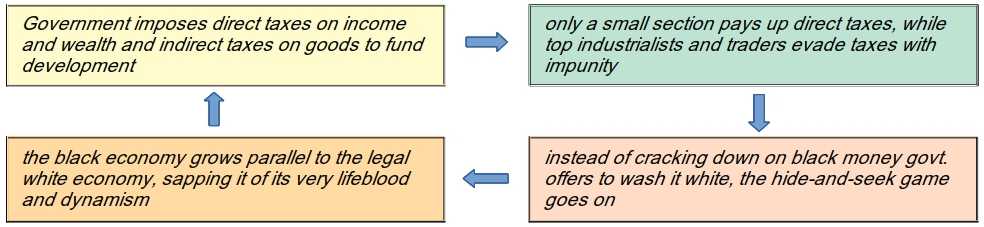

THE case of the black economy in India is a sordid example of how the cynical dictum that it pays to be corrupt and dishonest is actively nurtured by those in authority themselves. Consider the following chain of events that has been going on endlessly in this country ever since Independence :

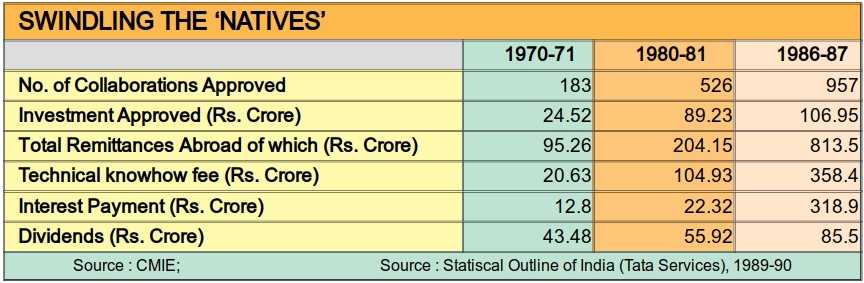

On the external front, too, the situation is the same. Both exporters and importers have for years been bleeding the Indian economy while through various means like under-invoicing exports and over-invoicing imports stashing away precious foreign exchange abroad. Using hawala operators corrupt politicians and industrialists regularly transfer large sums of money to bank accounts abroad. Indian agents of foreign companies (a la Bofors) are paid a substantial part of their commissions abroad directly resulting in a net loss to the Indian economy, And what does the government do? Under the pretext of attracting investments and tapping these illegal sources it shamelessly pleads with these anti-national swindlers to return money stolen from the country, assuring them in the tone of a sick father searching his absconding son, 'come back, all will be forgiven'!

The third dimension of the black economy in the country is smuggling. While gold, silver and electronic items have long been favourites with the mafia dons who operate smuggling networks with the help of their patrons in government, thanks to the recent devaluation and the hike in costs of normal import, the smuggling of other products is also likely to go up in a big way.

The only solution to the black economy problem is a politically and morally strong-willed government taking stern steps to ensure the implementation of laws and initiating punitive action against the offenders. But then how is one to expect a government propped up by the very same criminals to bite the hand that feeds them

- Size of the black economy: 20% of GDP, i.e., over Rs. 1 lakh crore

- Profit from illegal imports of gold and silver in 1990: Rs. 1,560 crore.

- Estimated flight of capital between 1971 and 1986: $ 28.6 billion or 71% of the external debt piled up over this period

BALANCE OF PAYMENTS: This is an account of the net economic transactions made by a country in relation to other countries. The transactions include exports and imports as well as transfer or receipt of funds and assets in various other forms like in our case remittances by Indian workers employed abroad and outflow of Indian resources on account of profit and royalty for foreign capital and technology operating in India and payment of interest and repayment of principal for our external debt burden. India's balance of payments situation has always been precarious since Independence indicating continued economic dependence on and vulnerability to external forces and factors. Since the beginning of the 'liberalisation' era the situation has become far more alarming.

BLACK ECONOMY: See box.

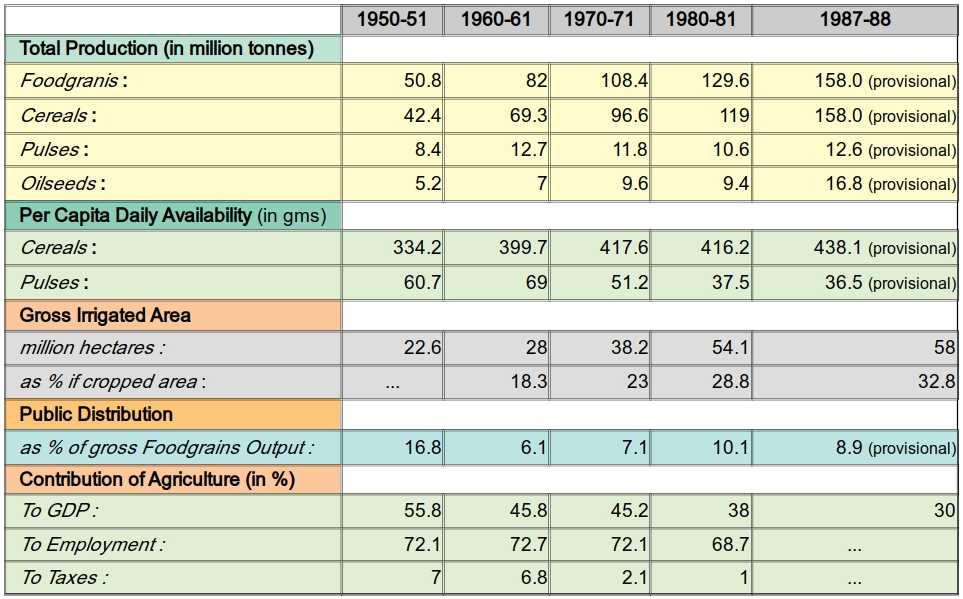

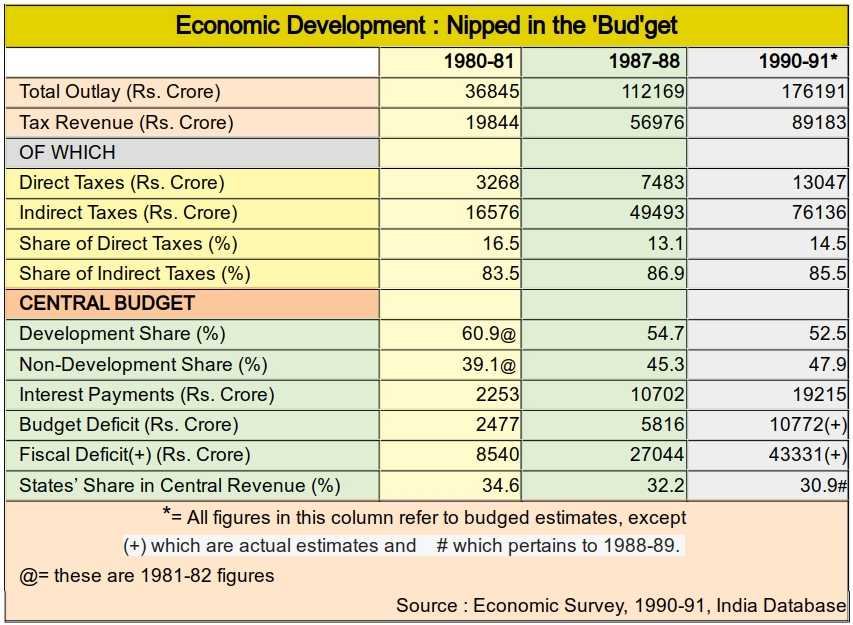

BUDGET: Presented to the Parliament usually at the end of February every year it is an account of the government's estimated spendings and earnings for the forthcoming financial year (April-March) and also a statement of the actual revenues and expenses of the outgoing year. The earnings come basically through taxes, revenues of government organisations like the railways and post and telegraph, and through domestic and external borrowings. The expenditures are incurred in running various government departments and financing the five year plans.

Taxes again are of two types – direct and indirect. The former is levied on wealth or income and the latter collected through excise duties and sale taxes on widely consumed products and customs duties on import. Naturally, direct taxes are collected more from the rich while indirect taxes pinch the pockets of the common man.

A shortfall in revenue against the government's expenditure is called a deficit. Most widely talked about today is the 'fiscal deficit' which is basically the difference between what the government plans to spend in a particular year including debt repayments and the total revenues it hopes to collect for this purpose from all its usual sources excluding external and internal borrowings. The bigger the gap, the more the government will have to borrow or print money or both to make ends meet.

Some of the salient features of the Indian budget in recent years have been:

- Falling share of direct taxes in total revenue and increasing dependence on indirect taxes which means the government and its institutions like bureaucracy and army run more on the common man's hard-earned income than on the rich man's share of profit.

- Rising non-plan expenditure which means more and more money is being spent on non-developmental areas such as defence, subsidies, maintenance of a huge bureaucracy and interest payments for growing debts

- Rising deficits indicating the government's utter failure in collecting the right revenue from the right source as also in economising its own operations.

- Falling share of resources transferred to the States showing increasing control of the Centre over the national economy leading to unwanted redtapism and arbitrariness in formulation and execution of developmental projects.

- Diminishing relevance of the budget presentation itself with the growing practice of raising revenue through extra-budget hikes in prices of key items like coal, steel, petrol etc., declaring major policy measures like devaluation and new trade and industrial policies outside the budget framework and rampant manipulation of budget figures in order to present a rosy picture of the economy.

CREDIT RATING: This is the index of a country's ability to pay back its debts to global lending organisations. The index is evaluated by international credit-rating agencies which keep a watch on the 'investment worthiness' of nations around the world. In the beginning of the last decade India had a good credit rating which enabled the government to borrow foreign exchange at will in international markets and pay the growing import bill of the country. But in August last year one of the leading credit rating agencies, the New York-based Moody's suddenly downgraded India's credit-rating sharply setting off a chain of similar downgrading by several other agencies. According to some observers the earlier rise and recent crash in our credit-rating are all part of a devious design to draw the country into a dangerous debt-trap.

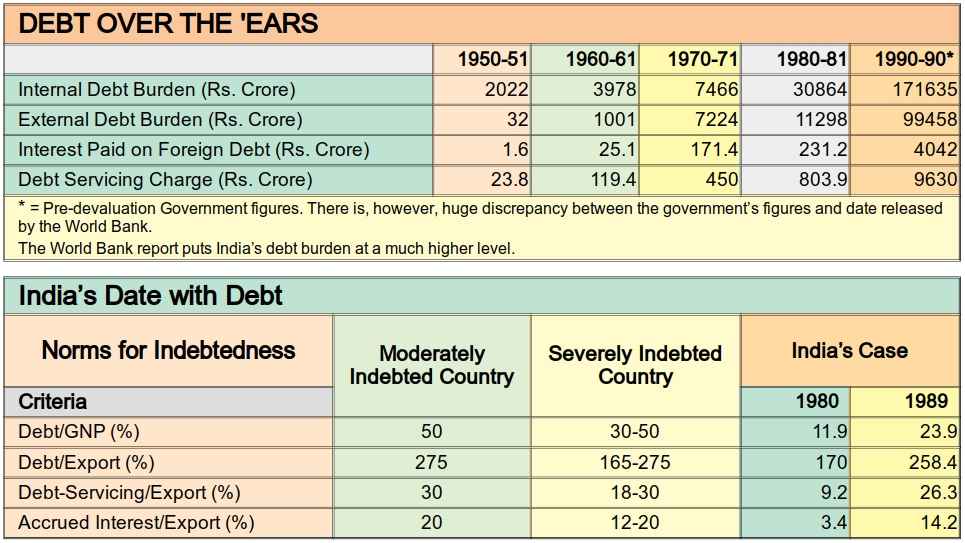

DEBT TRAP: A country can have two kinds of debt – external and internal. The former refers to the amount of loans to be repayed to lenders abroad while the latter is the money owed to lending sources within the country. Debt servicing refers to the amount paid by a debtor nation annually to its creditors on account of both the principal and accumulated interests.

After depending for years on aid in the form of grants and soft, i.e., low-interest and relatively unconditional loans, in the eighties India emerged as a major borrower of funds from commercial sources in international markets. The country is also borrowing funds by giving high interests and lot of other incentives to attract short term deposits in Indian banks from non-resident Indians. While the official figures put the debt in 1990-91 at nearly Rs. 99500 crores, taking into account the Rs. 20,000 crore in NRI deposits, the Rs. 30,000 crore in the form of other short term borrowings and various other kinds of external liability of the government, total external debt exceeds a whopping Rs. 175,000 crore or 70 billion dollars.

Rising Deficits

Behind the Fiscal Fixation

IT is commonly understood that if a person keeps on spending more than what he or she earns over a period of time there is bound to be trouble ahead in the form of first debt and than bankruptcy. So when the IMF sternly advises the Indian Government to cut down its fiscal deficit before approaching it for a loan, on the face of it the prescription seems to make sense. When establishment economists tell us that cutting down the deficit is the only way of controlling inflation the move appears even more sound. But what is the IMF's real interest in asking for narrowing the fiscal deficit?

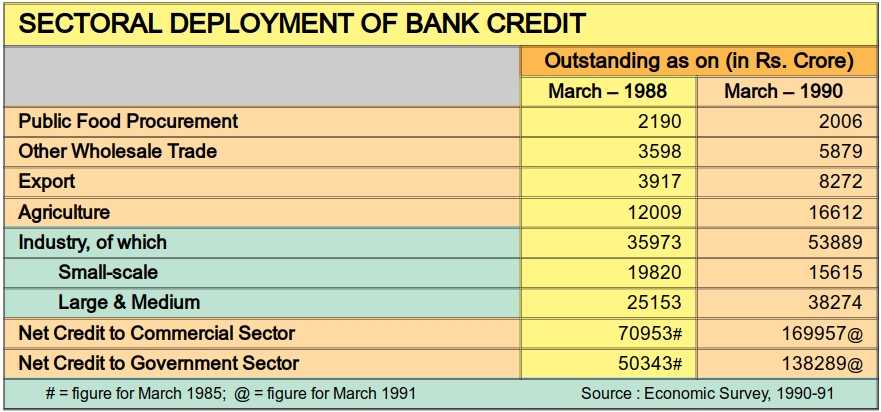

Surely not bringing down the inflation, which in fact in the Indian contexts is more related to the growing bank credit to the private sector and increasing profitability of speculative activity in stocks, real estate and the money market. While as a lending institution IMF is obviously interested in ensuring that the Government is in a position to repay its loans the measures it recommends for bringing down the fiscal deficit reveal a more long term strategy.

The experience of other economies where the IMF has successfully pressurised governments into accepting its 'cure' shows that (a) in the name of curbing deficits the first sector of government spending that gets hit is basic amenities and social welfare like health, education, rural development and the supply of essential goods at subsidised rates, (b) to raise additional funds public sector assets in core areas are sold off to domestic big business and global giants thus gifting them with a ready handle to squeeze and pressurise the nation, (c) a recession is often triggered off in several sectors of industry dependent on government purchases for a market. In other words, by picking out the fiscal deficit as the villain behind the economy's woes, the IMF ensures a systematic erosion of public welfare and the direct role of the state in the economy and hence attainment of its political-ideological objective of greater marketisation.

An important point to note here is that this recommendation is just one part of the larger 'liberalisation' package that is thrust upon the debtor country which includes the opening up of trade and industry. Ironically these policies which result in increasing dependence on borrowings and imports to sustain the delusion of 'export-led growth' also constantly ensure that the fiscal deficits of the governments never really come down substantially. This leaves the IMF and its pet economists with a ready scapegoat to flog while the 'cure' kills the patient. “They did not liberalise enough and their governments spent too much” would be the epitaph the IMF would love to write over the tombs of each of its victims.

Similarly, spurred on by wasteful expenditure on several counts the government's internal debt has also increased by a phenomenal six and a half times since 1980 and according to official figures themselves is likely to touch Rs. 171,635 crore by the end of 1991. Including other liabilities like employees' provident fund and small savings deposited in banks or in the custody of the government the actual amount of current internal debt of the government is estimated by others to be as high as Rs. 319,779 crore.

The foreign debt crisis facing the country can be best understood if one compares the growing servicing cost of external debt to the earnings through exports every year. This year the debt servicing to export earning ratio is expected to be over 30% or nearly one-third of revenues through exports. 20% is regarded as the safety limit beyond which the country falls into the debt-trap.

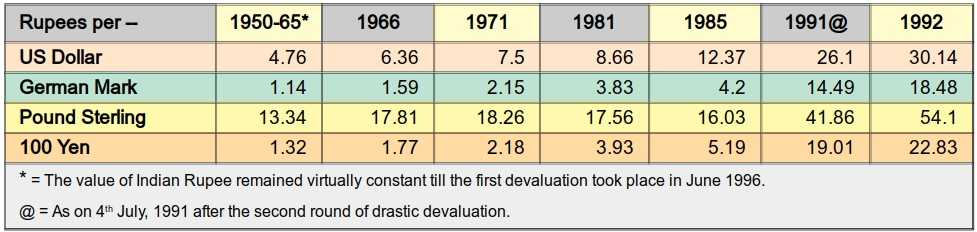

DEVALUATION : This refers to a reduction in the value of national currency against foreign currencies. In India recently the value of the rupee was brought down by 22 percent vis-a-vis currencies like the US dollar, British pound, German mark and the Japanese yen This step was part of the standard IMF prescription for debt-ridden economies and is done in the name of making the domestic products cheaper for buyers abroad so as to promote exports and hence the inflow of foreign exchange with which to repay outstanding debts. But exports and imports, being dependent on a lot of other domestic and international factors, often do not respond favourably, and in the bargain the devaluing country only ends up selling cheaper and purchasing dearer while the burden of foreign debt records an automatic rise.

Dwindling Value of Indian Rupee in The Global Market

ECONOMIC GROWTH :

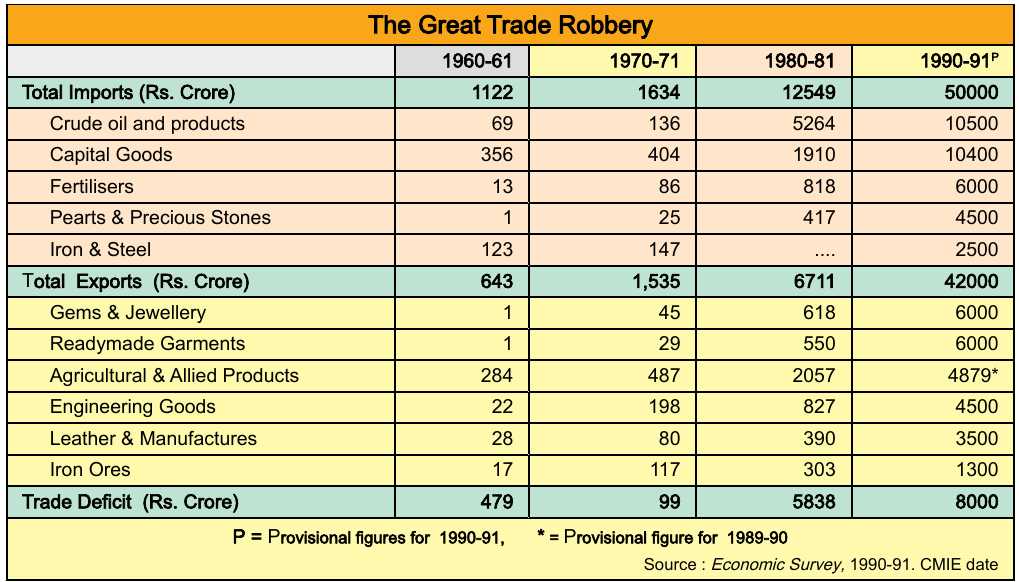

See chart box “The Great Trade Robbery”.

EXPORT-LED GROWTH : This is a doctrine which says that a nation's economy can grow rapidly if only it can manage to raise its exports in a big way. The most commonly cited 'success stories' of this strategy are the four newly industrialised 'Asian tigers-South Korea, Taiwan, Singapore and Hong Kong – whose rapid growth is attributed to their allowing exporters, both domestic and multinational, a free hand along with liberal government incentives and support.

Actually this is nothing more than a sweeping and misleading generalisation of the experience of thinly populated small port states whose economies were also to a large extent propped up by the United States for geo-political reasons. A big country like India with a vast agricultural population can only grow by first concentrating on the full development of its domestic market. Yet in the vain hope of export-led growth, Indian government has already dutifully devalued the rupee and virtually handed over the entire economy to domestic big business and foreign multinationals through its new trade and industrial policies. So far the outcome has been that while exports are growing too slowly to pull up the rest of the economy, imports have assumed alarming proportions pushing the country into a debt-trap. In other words, the dream of export-led growth has turned into the nightmare of an import-bred disaster.

FOREIGN EXCHANGE:

Frozen, Flying and Floating!

THESE DAYS the government is always complaining of a foreign exchange crunch. We are told that we do not have adequate foreign exchange to foot our import bill for even a month or honour our immediate debt repayment obligations in the world market.

Well, let us start from the other end oi the story. We have a staggering 12.15 billion dollars of 'frozen' forex in the form of unutilised foreign aid. The other day the Rajya Sabha was informed by the Minister of State tor Finance that this huge quantity of soft loans from the World Bank and the International Development Agency, meant mostly for pending projects in the fields of irrigation, thermal power, railway electrification, dairy development and road transportation is lying unused due to delay and the government's inability to release matching rupee funds.

There is also an abundance in another variety of foreign exchange, the 'flying' forex. An estimated 5 billion dollars of foreign exchange are illegally siphoned away every year from the country to 'safer havens' abroad. There are four major routes through which this flight of capital takes place:

(a) cash transfers through the hawala market where foreign exchange is illegally bought and sold,

(b) trade misinvoicing which means both an understatement of the export earnings and overstatement of the import bill,

(c) kickbacks or commissions paid into secret bank accounts of agents of foreign companies as in the case of the Bofors deal, and

(d) transfer of funds through banks (like BCCI) from one country to another.

According to a study made by the Department of Revenue Intelligence on the basis of figures for the 1984-88 period, every year the country loses an estimated

*$ 2.150 million of forex through hawala remittances,

• $ 1,200 million through under-invoicing of exports and

•$ - 700 million through over-invoicing of imports,

•$ 400 million due to non-repatriation of export earnings,

•$ 500 million through payments by foreign tourists to unauthorised dealers and

•$ 50 million through onward smuggling of articles.

Clearly then, the government's concern for forex is not about utilising the frozen forex and stopping the wasteful interest payments on unutilised loans. Catching the flying forex is also not on the government's immediate agenda. The government simply wants a ready and adequate fund of foreign currency, which we may call the 'floating' forex, to ensure an uninterrupted spree of imports.

GATT: Acronym for the General Agreement on Tariffs and Trade, it is an international forum meant ostensibly for promotion of world trade through a reduction of trade barriers and abolition of preferential trade agreements. The two major trade barriers are tariffs like custom duties which render import economically prohibitive and quotas which place physical restrictions on the volume of specific imports from specific countries. But like most other international bodies, the GATT too has been virtually hijacked by the US, the biggest trading country in the world to armtwist other nations, especially those from the Third World, into opening up their domestic markets to American capital and commodities.

GROSS DOMESTIC PRODUCT (GDP): A measure of the total flow of goods and services produced within the economy every year. This is obtained by computing the value of the total output of goods and services at market prices. The word domestic is used to distinguish it from Gross National Product (GNP) which apart from domestic production also includes the total foreign trade of the country during the year and inflows and outflows of funds in various other ways. In 1989-90, India's GDP at current market prices stood at Rs. 3,95,143 crore (measured at 1980-81 prices, it immediately becomes half, Rs. 1,97,419 crore), while the corresponding value of GNP was Rs. 3,92,524 crore (Rs. 1,95,237 crore at 1980-81 prices). So, our GNP is Rs. 2,619 crore less than GDP showing that we are a net loser in international transactions.

Another similar term used is the Net National Product or what is also called national income which is derived from the GNP after making adjustments for the wear and tear, and fall in values of various fixed assets of the country. In 1989-90, India's national income at current prices was Rs. 3,46,994 crore (Rs. 1,74,798 crore at 1980-81 prices.)

These terms are used as broad measures of the status of a nations economy with higher GDPs and GNPs supposedly indicating greater development. But hidden behind these figures are often factors like massive inequalities in the distribution of income, imbalances among various economic sectors and geographical regions, reckless squandering and criminal neglect of precious natural and human resources, all of which tell considerably on the nature and level of economic development.

I hereby promise you THE RIGHT TO get WORKed up” --- Biswanath Pratap Singh.

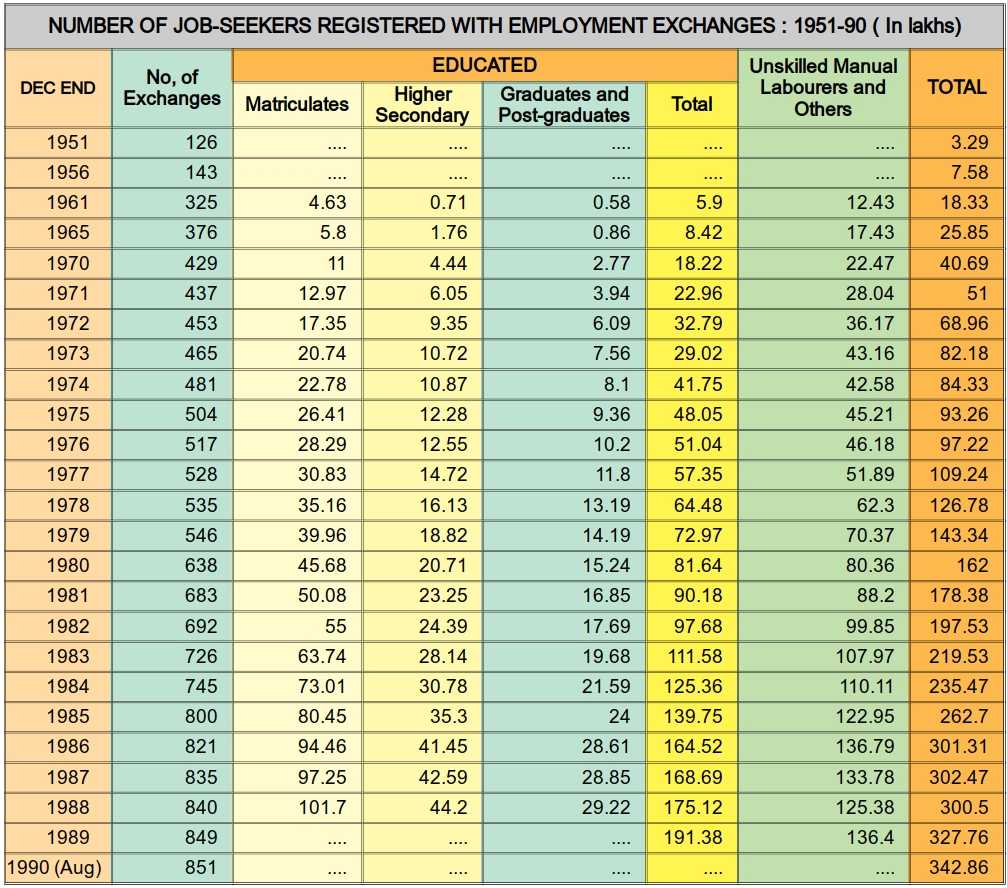

Job SEEKERS : (in million)

HARD CURRENCY : A currency which is easily tradeable for goods and services and other currencies in any part of the world. For instance, the US dollar has universal acceptability as a hard currency. However, in recent years the Japanese yen is fast dislodging the dollar from its traditional position of global pre-eminence. The IMF, however, generally uses a combination or basket of currencies which is called a Special Drawing Right (SDR). At present, the value of 1 SDR is a little more than 1 US dollar.

HOT MONEY : Funds which flow into a country to take advantage of higher interest rates prevailing there. In India non-resident Indians have been depositing such 'hot money' because of the government offering them special rates of interest and various concessions. The major danger with such deposits is that often this money is borrowed from other banks abroad and is a front for Indian investors with illegal foreign exchange. These deposits can also be withdrawn at very short notice suddenly depleting the government's foreign exchange reserves.

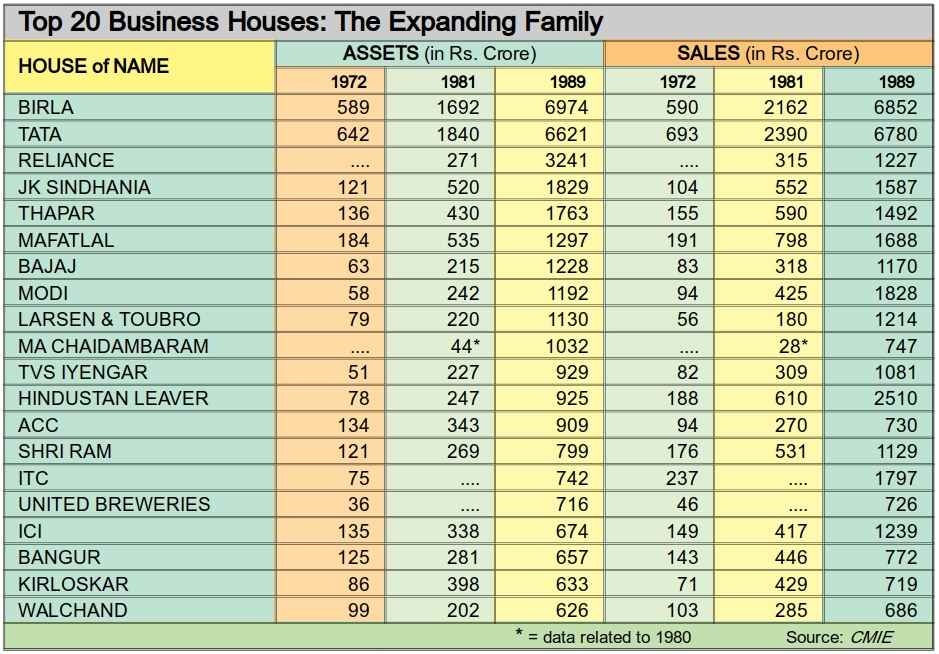

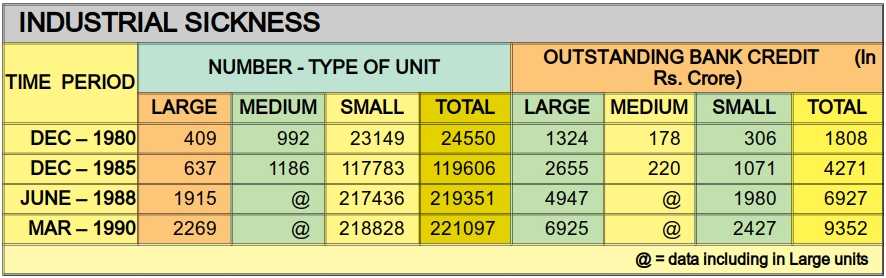

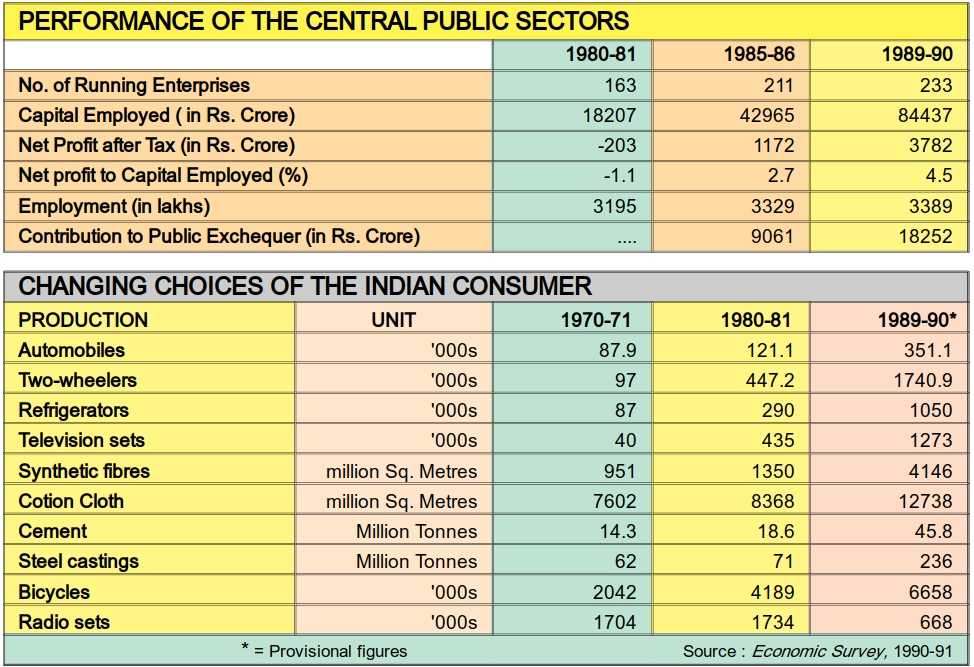

INDUSTRY : Like agriculture, industry in India is also ridden with ironies. Here are some of the major ones.

- While India boasts of being one of the largest industrialised nations in terms of volume and also variety of output, in terms of cost, quality and management, Indian industry is highly inefficient.

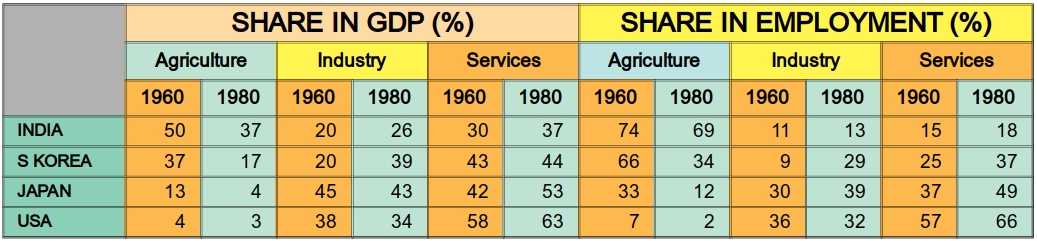

- While the share of industry in GDP is now almost equal to that of agriculture, industrial employment is only a small fraction compared to the workforce engaged in the agricultural sector. In other words, our industrial structure is highly capital-intensive while the country is short of capital and surplus in labour.

- Our industry is still largely dependent on foreign technology, foreign funds and imported inputs. This dependence has been particularly aggravated in the eighties due to the policies of liberalisation.

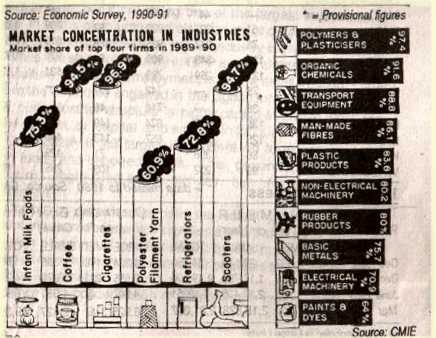

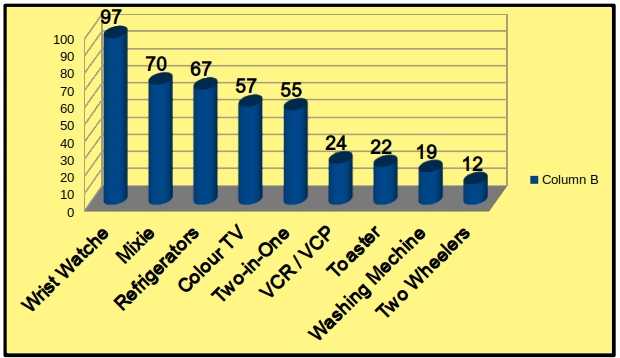

- Consumer durables has been the fastest growing industrial segment in recent years which signifies a sharp shift away from the production of essential goods needed by the masses of ordinary working people to luxury and consumer products for the consumption of the Indian elite.

- While the concentration of assets in the hands of the top industrial houses has continued relentlessly the number of industries turning sick and the number of workers thrown out of employment has also risen atrociously.

- Far from snapping the umbilical chord between trade and industry, large sections of Indian industrialists still prefer to operate in the twilight zone between production and speculation. Given half a chance many of our industrialists would close down their factories and embark on real estate business instead.

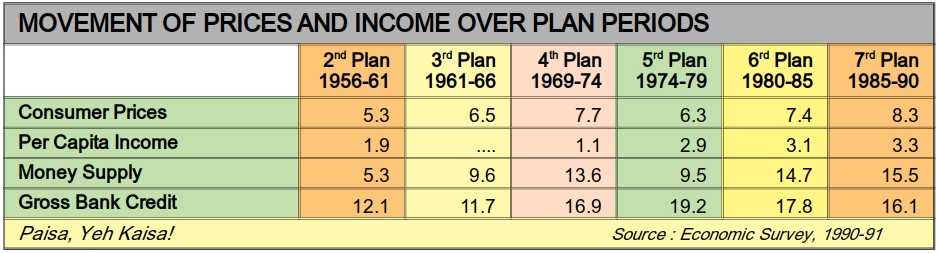

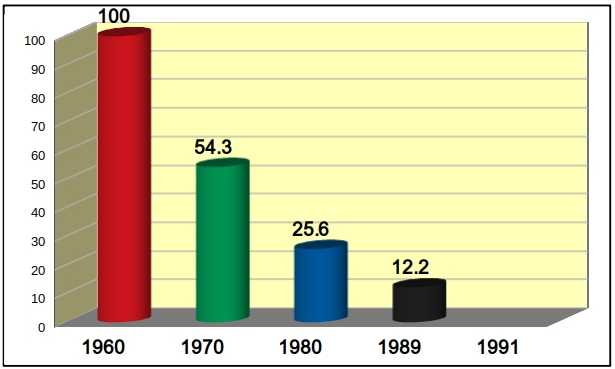

INFLATION : Inflation in simple terms is the rise in prices of various goods over a period of time. Basically this may be caused due to two broad reasons: (1) due to the 'cost push' given to the prices of key inputs like petrol, coal, steel etc. by the government which translates into an escalation of prices all around, and (2) due to increase in the supply of currency circulating in the economy resulting in ‘too much money chasing too few goods'. For example the money supply in the economy is increased whenever the government faced with shortage of funds to balance its expenditure resorts to the easy way out by simply printing more currency notes for its use.

But a close examination of the economy reveals a number of additional culprits: (1) the large amount of credit given to the corporate sector in the past decade which has also enormously increased the money supply in the economy, In fact in 1989-90 the private sector had borrowed Rs. 22,630 crore from banks as against a borrowing of Rs. 19686 crore by the government, (2) the indiscriminate increases in indirect taxes affecting prices of essential commodities, and (3) the entry of vast amounts of black money in the trade of various goods and increased speculation in real estate.

Purchasing Power of Rupee (with 1960 as base)

Source : Statistical Outline of India (Tata Services), 1989-90

IMF-WORLD BANK

The Deadly Duo of Debt Imperialism

IMF IS the abbreviation international Monetary Fund. And the full name of World Bank is the International Bank tor Reconstruction and Development. As implied by their names, the two organisations have a formal difference in their functions. The Fund is more in the nature of a general lending agency while the Bank arranges loans for specific projects and also monitors the development and working of such schemes. But the two are not only twins, they also work in tandem.

The inception of these twin organisations in 1945 through an international conference at a place called Bretton Woods in the United States was an integral part of the global realignment of forces after the Second World War. Though these organisations have a multilateral appearance and composition and their funds come from the contributions of various member countries, in reality like the United Nations these two organisations are also controlled by the big industrial powers, the United States in particular.

In the garb of promoting international economic cooperation, the Fund-Bank nexus has proved itself to be the most trusted custodian of the interests of the imperialist economic order. The IMF has in fact emerged as the supreme arbiter of the global loan market and attained complete mastery in the an of influencing the economic policies of the debtor country with a meager amount of debt. For instance, the share of our borrowings from the IMF in our total external debt was only 4.75% in 1980 and went up to a peak of 14.78% in 1983 before declining to sheer 2% by 1990.

The combine has several ways of playing this game. Apart from crude methods like direct intervention and imposition of conditionalities, it also uses subtler but often more effective means like educating and training Third World economists and administrators who then 'independently' steer their own economies along the Fund-Bank path. What is particularly galling about the Fund-Bank sermons to the developing countries is that the combine maintains a totally different standard for the industrial powers. For example, since the mid-80s the US has emerged as the world's largest debtor nation running up an external debt of over $ 650 billion by 1990. Further, its internal debt is currently an astronomical $ 3,336 billion whiie since1984 its trade deficit has averaged over $100 billion annually. And yet, as the Cuban leader Fidel Castro put it a few years ago, the IMF never sends its experts to the White House to correct its most in incredible deficits despite its location just a few blocks away from the IMF headquarters in Washington".

INTELLECTUAL PROPERTY RIGHTS : This refers to the view that inventions, research and development constitute 'intellectual property' and any use of such work should entail payment of royalties or fees like in the case of actual material properly. The advanced nations led by the United States have been insisting that all developing countries sign the treaty concluded at the Paris Convention which lays down the norms for protecting patents for expertise and technology developed in different parts of the world. India along with several other third world nations was put on the Super 301 and Special 301 lists by the United States whereby exports from these countries were threatened with severe restrictions for allegedly not protecting the rights of 'intellectual property' of the United States.

Signing the Paris Convention would mean that Indian farmers will have to pay royalty to the Americans for using high yielding variety seeds and Indian drug companies would have to shell out huge sums of money as patent fees for manufacturing even the simplest of medicines. While the US makes a lot of noise about protecting its own 'intellectual property' it keeps silent on the billions of dollars that third world nations lose annually due to the westward migration of their professionals. Maybe it is time the Third World started demanding 'royalties' from the West for the phenomenal siphoning of resources and valuable knowledge during the entire colonial era and now the on-going brain drain in the age of neo-colonialism.

Brain drain costs India $51 billion

LONDAN, April 14, India transferred over $51 billion in brain power to the United States and other Western nations between 1967 to 1985, according to a study by two leading British scientists.

The study said that when skilled people like engineers and scientists move to other countries they take with them all the capital invested by state resulting in a brain drain. The capital referred to here is the money spent on education and training.

Experts estimate that by adding the money that it takes to educate a scientist or engineer and their average productivity. India transferred $51 billion in human capital to the United States between 1967 to 1985.

Professor Alan Smithers and Professor John Pratt of the University of Survey, in their study said that industralised nations, most notably the United States, encourage the influx of scientists to meet their growing demand.

The study also found that between 1974 and 1988 the number of immigrant scientists and engineers in the United States doubled to 10.5 per cent of the total from 5.8 per cent and the five leading sources of this talent were India, Britain, Taiwan, Poland and China.

The UN Conference on Trade and Development (UNCTAD) found that some developing countries lose 20 per cent to 70 per cent of their annual output of doctors. Over the last two decades, the number of American earning advanced degrees has declined, leaving empty seats that have been fulled by foreigners.

Doctoral degrees earned by non-citizens in 1972 was 15 per cent and in 1989 it was 26 per cent. In new Jersey Institute of Technology, 734 out of 887 full time students are from Asia. In the University of Texas 205 of 355 civil engineering students are non-Americans. At some universities foreign application out-number domestic ones.

Also, Americans cannot make the grade because on lack of motivation and training from kindergarten to collage level. The drop has been steepest in technology and hard sciences. – ANI

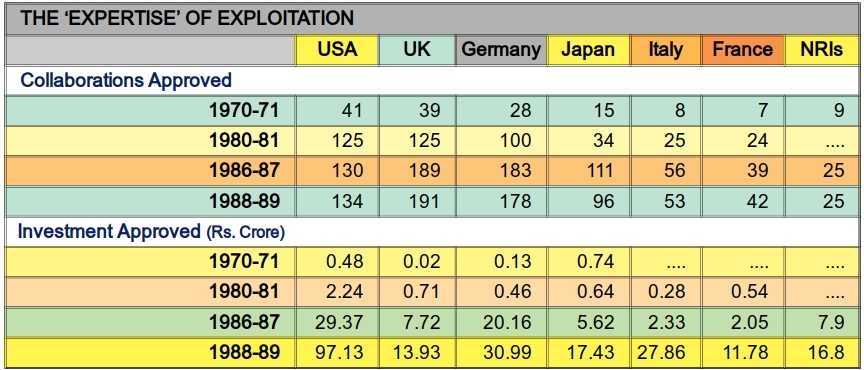

LIBERALISATION: This is the term used to describe the process of removing curbs and control son domestic and foreign industry in the economy. Initiated by Mrs Indira Gandhi in the early eighties after the first IMF loan this policy was pursued vigorously by Rajiv Gandhi from 1985.. While the removal of red tape and bureaucratic controls over the economy is always welcome, in India this has meant basically unrestricted freedom for domestic big business houses and foreign multinationals to reap super-profits and for the social elite to buy all the consumer goodies they want with borrowed foreign exchange while at the same time shackling the common people in the prisons of unemployment and poverty.

Source : CMIE

THE ACQUISITIVE CLASS

% of 18-30 year olds living in households* owning the following consumer durables

*= families with a month income above Rs. 2,500 in the four metropolitan cities

Source : PATHFINDER Survey

MULTINATIONALS: These are giant size companies with assets and production bases spread over several nations outside their parent country. Many of the multinational corporations, or MNCs as they are commonly called, today have turnovers larger than the gross national products of many third world nations. For example ITT, one of the largest US multinationals has 700 subsidiaries in 67 countries on 6 continents and alone accounts tor one third of USA's balance of payments.

Multinationals

The Fatal Attraction!

THE $ 70 billion debt burden is not the only indication of our declining national strength. Perhaps a more frightening pointer is the sordid clamour for attracting foreign investments in the country. The official propaganda machine wants the nation to forget the 'absurd dream' of self-reliant industrialisation and development and take to worshipping everything foreign or 'global', as the new rhetoric goes. We are being told that foreign investment is a much more lucrative proposition than foreign debt, for our headache to pay interest will be replaced by their headache to earn profit. And they cannot earn profit without giving us a share in the shape of greater production, employment, wages, exports, technological knowhow and what not! Moreover, total foreign investment in our country is still only $425 million, less than a third of what even China has, $1400 million.

All this is excellent suicidal logic, China has a GDP double of ours and what is more crucial, their manufacturing output is four times larger and exports more than threefold. And thanks to her superior national, economic and political strength, socialist China has far greater manoeuvrability and bargaining power against foreign capital than India. Moreover, our experience with foreign capital shows that (a) in most cases foreign investment does not mean opening of new factories or fresh addition to productive capacity, it just means transfer of shares in existing companies from India to foreign hands with the obvious implications of a shift in managerial control and outflow of national resources, (b) instead of earning foreign exchange for us through exports, foreign investment shows much greater interest in capturing the market of low-priority, high-profit consumer goods and thus eating into the domestic industrial base, Pepsi being a scandalous current example, (c) foreign investment is generally accompanied by a technology which is internationally outdated and nationally inappropriate, wasteful and labour-displacing, and last but not the least, (d) foreign capital is often found to operate in a most shady and arbitrary manner, defying every modicum of accountability and flouting every law of the land, even committing genocide with impunity.

Bhopal was no aberration, if only exposed in a brutally objective manner what a reckless and arrogant multinational can mean to a people. Especially when it is abetted and shielded by a corrupt, anti-people and spineless government. And while our collective conscience continues to rage against the disgrace of Bhopal, recent history of Asia, Africa and Latin America is replete with examples of subversions of a different order – multinational-sponsored military coups, large-scale espionage and fascist insurgency operations and propping up of any number of corrupt and authoritarian regimes.

The attraction of the multinational could well be fatal.

NON-RESIDENT INDIANS: They are people of Indian origin living abroad and engaged as employees, professionals or businessmen. The government in recent years has identified NRIs as a potential source of investment in the country and offered a number of incentives including as in the present budget a scheme whereby they can deposit any amount of funds in Indian banks without any questions being asked about the origin of the money. While genuine and patriotic-minded NRIs should no doubt be encouraged to contribute to national development, in actual practice many NRIs are nothing but fronts for Indians with black money or for smooth operators abroad looking for concessional NRI avenues to enter the lucrative Indian market.

POVERTY LINE: Poverty in India has been defined as that situation in which an individual fails to earn income sufficient for bare means of subsistence. Poverty line is a cut-off point used to quantify the extent of poverty. One indicator used is the calories of nutritional intake of a person with the cut-off point calculated as 2250 calories per person per day. Using such narrow criteria the Indian government has been claiming that the percentage of poor in the total population has been steadily declining. The absurdity of considering nutritional intake alone as a criteria to determine poverty is evident from the fact that other vital inputs such as shelter and clothing have not been taken into account.

Ironically, while on the one hand the Indian ruling elite is trying to model its own standard of living along the consumption patterns of the affluent West, it refuses to redefine the concept of poverty line in India which is really nothing more than sheer starvation line. In monetary terms, a family of four in the US is regarded poor if its earnings are below $11,000 a year or $ 900 (i.e., more than Rs. 20,000) a month. In India, in sharp contrast, for a household of five the Planning Commission put the poverty line at an annual income level of Rs. 9120 in urban areas and Rs. 7,980 in rural areas for the year 1987-88.

DUNKELSPEAK!

| URUGUAY ROUND : | Eighth round of multilateral Trade Negotiations being held under the auspices of GATT. Since the round was launched in Punta del Este in Uruguay (in September 1986), it bears the name Uruguay Round even if meetings of this round are held in Geneva or elsewhere. The round, launched primarily at the initiative of the US and Japan, saw the GATT purview being extended to trade in services and various aspects of domestic policies including patent laws, treatment meted out to foreign investment and subsidies given to various groups of producers. |

| TRIPs: | Trade-Related Intellectual Property Rights |

| TRIMs: | Trade-Related Investment Measures |

| CATS: | General Agreement on Trade in Services |

| PARIS CONVENTION : | Multilateral economic treaty for the protection of industrial property, dealing with patents, trademarks and designs. Founded in 1683 by 13 members, mainly the imperial powers and their satellites. |

| SPECIAL 301 : | A clause in the United States Omnibus Trade and Competitiveness Act 1988, under which India has been put on "priority watch" list since June 1989. The threat was carried out on April 30, 1992, when Indian exports of drugs and pharmaceuticals were struck off the duty-free list for India's alleged violation of US intellectual property rights. |

GATT TALKS

Don't Say Uncle to Dunkel

UNLIKE in the past when GATT negotiations were confined to inter-country trade issues, the Dunkel proposals bring within their fold subjects of domestic policy lke patent laws, subsidies provided to farmers and exporters and investment and banking practices, thereby undermining the freedom of individual countries to choose internal policies of their liking,

The implications of succcumbing to the pressure to conform are grave for India.

a) The country's existing patent laws will have to be changed to grant product patents instead of just process patents as at present. This will prevent Indian manufacturers from producing domestically any product patented abroad, making imports inevitable and pushing up prices especially in the vital area of medicines.

b) The government wilt lose all control over the working of patents. This means that the production of items of national and social importance will be left to the whims of the patent holders, and that too foreign ones.

c) India will have to cut down subsidies to farmers or face penalties. This will increase the cost of agricultural inputs and push medium and poor farmers out of work with dangerous implications for the nation's food security.

d) The patenting of seeds and plants will force Indian farmers to pay royalties every time they sow a new crop and make the county's agriculture totally dependent on multinationals.

e) The proposals do not give India any advantage in its two areas of strength vis-a-vis other nations i.e., textiles and services in terms of increased access to Western markets, while India will have to give MNCs a free hand in entering the domestic market without imposing any obligations on them.

PROTECTIONISM: The practice of imposition of barriers by a government through tariffs or quotas to restrict inflow of imports into the domestic economy. While the developed countries are pressurising developing nations through forums like GATT and IMF into opening up their markets they themselves are zealously guarding their own domestic markets behind increasingly protectionist barriers.

SERVICES: These include a whole array of governmental and private activities in the fields of administration, law and order, defence, construction, banking, insurance, education, culture, advertising, media, tourism and the like. The original role of the service sector was that of a lubricant for the economic machine moving on the wheels of agriculture and industry. However in India there has been a totally disproportionate swelling of the service sector with little relation to the actual requirements of the economy and society. And again within the service sector basic needs like housing, healthcare, education and social welfare get the least attention while administration, defence and internal security comer the lion's share of funds.

STOCK EXCHANCE : A market where shares and securities of various companies are bought and sold. This institution which has become a key symbol of capitalist economies is basically a mechanism through which companies raise funds ostensibly for use in setting up new industries and improving existing ones. It is also supposed to be a forum for the general public to invest its savings and earn interest and dividends according to the performance of the company whose shares they have bought. In actual practice it is found that brokers and industrialists who can manipulate the stock market make more money out of indulging in speculative selling and buying than by using the money for generating profits through production.

SUBSIDIES : Subsidies are compensatory payments made by government agencies to producers and traders of goods and services with a view to holding the concerned prices below a specified level. For example the fertiliser subsidy paid to fertiliser manufacturers is supposed to enable them to sell the product at below production costs to farmers. Scrapping of subsidies has always been a standard prescription of the IMF. But the real problem is that the bulk of subsidies in India are not properly targeted. For example, not even half of the total subsidy on health services and one-third of the subsidy on water supply, sanitation and housing flow to the rural sector which houses 75% of the overall population and also the majority of the population below the poverty line.

According to a study commissioned by the Planning Commission on the subject in 1987-88, the actual volume of subsidies was a phenomenally high Rs. 43,324 crore which is almost 15 per cent of the country’s GDP. The same year however the government showed a total subsidy bill of only Rs. 5,892 crore in its budget. The question that the IMF and its pet economists cunningly evade is who gets these huge ‘hidden subsidies’ and why is nothing being done to stop the criminal drain and misuse of this public money.

Economic Growth

Opium of the Economists

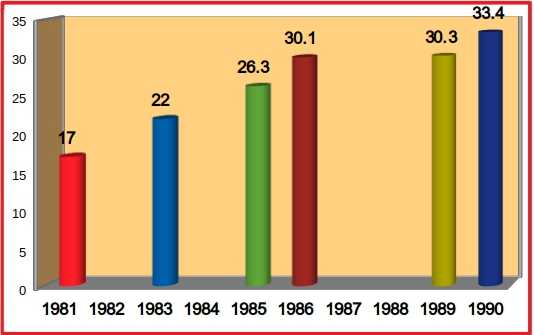

AFTER the magic term 'liberalisation' the one other mantra chanted most by establishment economists has been 'growth'. At the end of the Seventh Five Year Plan, we are told, the country achieved a growth rate in GDP of 5 per cent and in the next Plan this is slated to go up to 5.5 per cent. But impressed by the rhetoric, when we look around us, we first see only decline all over. Decline in our real incomes, decline in government services, decline in employment, decline in the quality of life. Ah yes, how stupid of us not to see the 'growth' – in prices, the assets of the top business houses, the luxurious consumption of the middle and upper middle classes, in the country's external debts and trade deficits, not to speak of the 'growth' in the per capita availability of colour television sets and Maruti cars.

The word 'growth' while having every positive ring about it paints, like most other terms in economics and statistics, a very distorted picture of what is really happening to the Indian economy. On close scrutiny one finds that even the much touted 5 percent rate of growth has been conjured up only by tagging the booming service sector to the relatively slow-growing agriculture and industry which really constitute the backbone of our national economy.

But isn’t the expansion of the service sector the hallmark of a developed economy? Yes it is, but the problem that in our case this growth resembles more an under nourished body with as shollen head. The rapidly increasing share of services in GDP is only a sign of lopsided development, whereby the country acquires the glamour and gloss ot an advanced economy while remaining basically poor and without a proper foundation in industry. Also disturbingly unlike in the advanced nations, where the growing service sector absorbs a proportional section of the national workforce, in India it accounts for barely one fifth of the labour force while cornering more than 40% of the national income.

A conspicuous consequence of such abnormal growth has been the swelling of a segment of the society, which while not producing anything tangible and contributing little to the economy, fuels inflation with its high spending power and promotes an import-hungry consumer durables market. The cost of this ‘growth’ is borne of course by the urban and rural poor for whom the only thing that grows is their long list of miseries.